Establishment lies about Covid-19 continue. In the UK, currently there is an inquiry into the pandemic. It is as much of a sham as the mainstream media’s coverage of it. Due to a bereavement, I’m briefly back in the country, and watched the 6 o’clock ITV news for the first time in a long while. Their viewers were encouraged to assume that lockdowns were a good idea. That’s ignoring evidence from comparing the policies of various countries which has shown that lockdowns didn’t help curb the disease, while also generating widespread damage to both physical and mental health. That’s before we even consider the damage to small businesses and ordinary people’s incomes. The viewer was also encouraged to think the only alternative to lockdowns would be a callousness in letting the virus kill the elderly and vulnerable. There was nothing mentioned about other interventions that could have helped, such as air filtration systems or helping symptomatic workers to stay home. Learning meaningful lessons to curb Covid-19 transmission is incredibly important, as the virus remains an ongoing threat to long-term health due to recurring and persistent reinfections. If you are unsure what I’m talking about, or want to see official evidence and scientific papers for what I’ve just stated, then please review my essays on the topic, since October 2021.

As there has been no discussion during the British inquiry on what might be learned from other countries, the short sightedness arising from misplaced superiority was clearly on show. Or perhaps that was intentional, because what we might really learn from the pandemic is too risky for the elites. As top scientist Carl Heneghan wrote, the scandal goes well beyond the corrupt allocation of contracts, the massive transfer of wealth to big tech firms and pharmaceutical companies, or Britain’s below-average performance on mortality when compared to other countries “despite” its rapid vaccine rollout. In particular, Britain’s chattering classes don’t approach the matter of how, when, and why, the monied elites responded in the ways they did. But as a subscriber to my blog, you can hear some ideas on that…

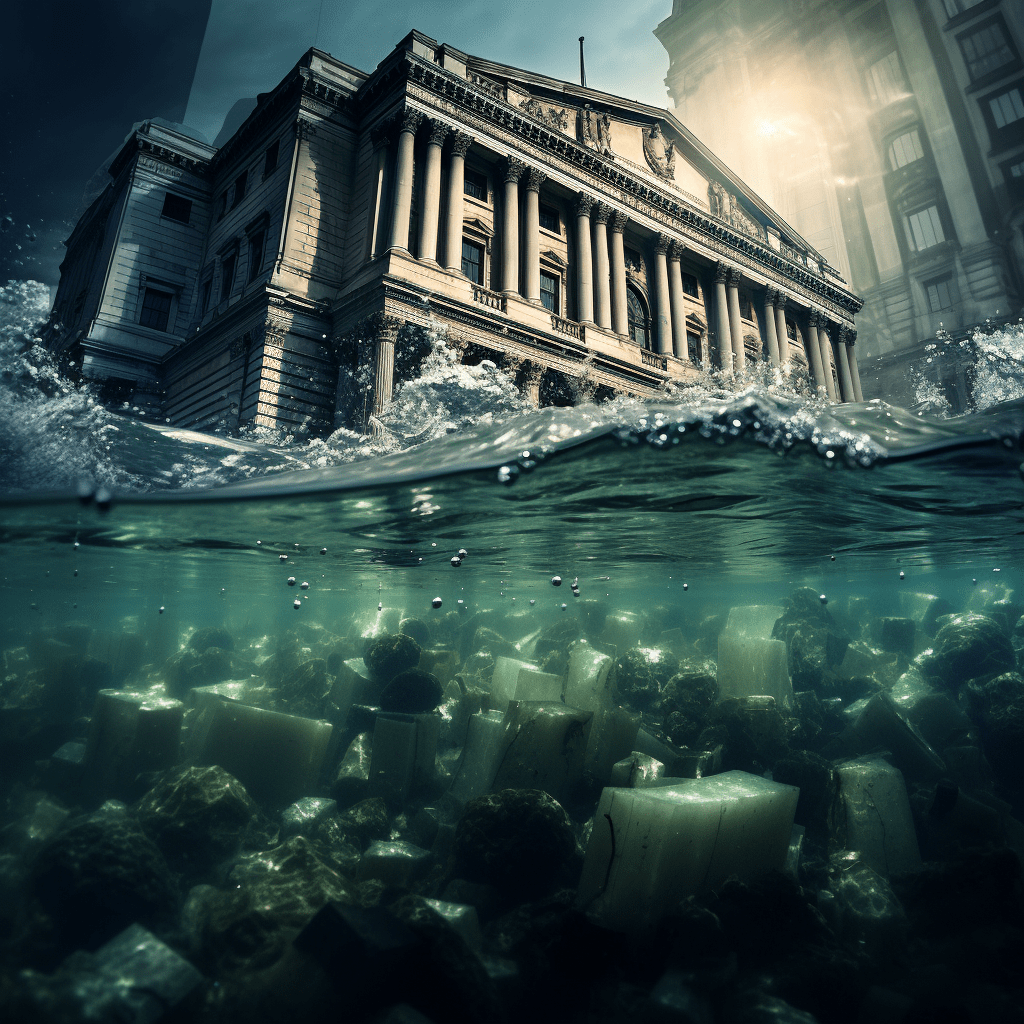

In Chapter 2 of Breaking Together, I describe how the Bank of England launched their corporate bond buying programme just before the first lockdown, using that lockdown as their excuse, and thereby impoverishing poorer Britons by driving up inflation. After nearly 4 years of ignoring this matter, I don’t expect any journalists to discover the smarts and ethics to get this scandal into the mainstream media. I share what I understand to be the truth not to get a public debate going – my reach is far too small for that – but because the truth of what is occurring matters to those who are willing to hear it. It means we should all share what we know, even if we are marginalised. Perhaps especially because of that. Therefore, below I am sharing the opening of Chapter 2, which provides the damning chronology of decisions in March 2020. You can also listen to the whole chapter for free here. If you think the analysis sounds a bit conspiracist, then I understand, as some have used the fraudulent monetary policies launched during the pandemic to claim that the whole disaster was pre-planned. However, I have not reached such conclusions, as I don’t have sufficient evidence for that yet. Without evidence, such speculations distract us from those abuses which are clearly documented, and where there should be general public outrage, rather than just a niche of contrarians. And we mustn’t be distracted, because the problems with both Covid-19 and the disastrous policy responses have not gone away. Both reinfections and long-Covid are rife, with serious implications for people’s health, while excess deaths remained above normal in highly vaccinated countries and haven’t been explained by Covid itself.

Subscribe / Support / Study / Essays / Covid

In my book I explain the nature and need of ‘critical wisdom’ to reduce the ways we are manipulated during disruption and collapse (in Chapter 8). But if people are bombarded by misleading narratives on primetime TV, from all main channels, there is little chance for that. Instead, it appears that the impetus for change will need to come from elsewhere in the world. That has major implications for where Western activists could choose to direct their efforts in future. It is why I am delighted that translations of Breaking Together are underway that will bring the book to Latin America, Francophone Africa and China next year, and why I will be travelling unusually in 2024. In case you’re interested, I calculated that my carbon footprint for that tour will be about 0.0000157% of the Pentagon’s annual CO2e emissions (excluding major increases since 2018 due to wars they support but don’t fight, such as in Ukraine). So I can plant 50 trees on my farm, encourage its soil carbon content, and keep complaining about war and the monetary drivers of war (all of which may prove to be ineffectual). I’m lucky that most of my work is now online, such as the leadership courses I co-teach.

Excerpt from Chapter 2 “Monetary collapse: it was made inevitable.”

At 8:30 p.m. on 23 March 2020, then British Prime Minister Boris Johnson announced a stay-at-home order effective immediately, backed up by the subsequent regulation three days later. The stated aim was to “flatten the curve” of the rate of infections. So, he launched the slogan “Stay Home, Protect the NHS, Save Lives” and said that the lockdown would be reviewed every three weeks. This was unprecedented and came as a surprise to the public. But a week earlier, on March 17th, the Governor of the Bank of England, Andrew Bailey wrote to the chancellor Rishi Sunak outlining a similarly unprecedented measure, which would direct tens of billions of pounds directly to large corporations:

“The new Covid-19 Corporate Financing Facility (CCFF) will provide funding to businesses by purchasing commercial paper of up to one-year maturity, issued by firms making a material contribution to the UK economy. It will help businesses across a wide range of sectors to bridge across the economic disruption that is likely to be associated with Covid-19, supporting them in paying salaries, rents and suppliers, even while experiencing severe disruption to cashflows. The Bank will implement the facility on behalf of the Treasury and will put it into place as soon as possible.”[i]

At the time the governor wrote this, business activity was still normal. Even if it had taken the prime minister a week to decide to lockdown, the official understanding at the time was that a lockdown would last only a few weeks. And while it was reasonable to expect limited economic disruption from a short lockdown, there were no indications that private financial markets wouldn’t have coped with it. Was the governor clairvoyant? If so, he would have had to have had the vision some months earlier, as it takes a long time for entirely novel funding mechanisms to be established. However, his clairvoyance didn’t stretch to seeing how the corporate recipients of his largess would use the funds. Within months, approximately 39% of CCFF participants had large-scale redundancies planned, totalling over 34,000 UK-based jobs. Of course, any businessperson knows that just because you can borrow money cheaply doesn’t mean you will spend it on wages of staff you don’t need for customers and income you don’t have. Frankly, the governor’s letter could convince only the most gullible people with zero business sense. Yet the media dutifully accepted illogical explanations and ran stories about the Bank of England’s sensible response to a crisis. But if the Bank of England was not really giving money to corporations for “supporting them in paying salaries”, what was it really doing?

To begin to answer that question one needs to understand how monetary systems function today, and how they are not only hastening the collapse of both natural and human systems but are known to be on the verge of collapse by some senior officials. In this chapter, I will explain key aspects of monetary systems and show that it was not the pandemic but geopolitical power struggles that lie behind the recent monetary policies. I will explain that because many senior officials know that the current monetary system must collapse at some point, it is rational for them to have scheduled that collapse—or a rough transition with banking casualties—ahead of time.

I am dedicating a whole chapter of this book to the soon-to-be-collapsed monetary system in full awareness that this topic seems both impenetrable and boring to many readers. This opaqueness and the reluctance of the general public to engage with the topic reduces public scrutiny and political intervention in monetary policy. To counter that, I continue to include monetary issues in my analysis and recommendations (Chapters 10, 12 and 13). My own desire to understand the mechanics of power overrode my aversion to the complicated and boring language in monetary economics back in 2006 when I was a senior manager of a team working on economic governance at the environmental group WWF. One day at work, my boss Robert Napier passed me in the corridor and said: “Take a look at how the Mann Group makes its money. It’s absolutely crazy.” That started me on an intellectual journey that progressed from learning about how hedge funds like the Mann Group made their outrageous returns, to then looking deeper at the monetary system. I began to learn that the nature of banking, and how money is created, shapes the way we experience both the economy and society. From such work, I became a contrarian critic and proposer of alternative approaches. For instance, in my TEDx talk in 2011, I described how currency innovations like Bitcoin were taking off and called for communities and local governments to create their own currencies before Facebook did. The topic had become my obsession. The following January, I stood up in the plenary hall in Davos, at the World Economic Forum, and asked the CEO of Google about whether they would launch a global currency. I wanted to sense whether tech and banking would stay separate, or there might be a race to control the future of money.

What I have learned from a mix of reading heterodox monetary theory, engaging with libertarian software engineers and talking to people at high level events like those of the World Economic Forum and United Nations, has given me a framework for analysing what I have seen in the last few years of monetary policy. Many private bankers I have spoken to believe that the current monetary systems will not last. They know the era of hegemony of the US dollar is coming to an end as oil purchases become far less significant to national economies in the coming years. A smaller number also know about the environmental limits and economic contradictions of our expansionist monetary systems. Therefore, they anticipate a collapse and want to enable some options for their countries, institutions and elites to retain power within whatever monetary arrangements might take over. To understand this situation, one needs to understand how the current monetary system actually works, how it has been a threat to the stability of humanity and the biosphere, is now beginning to reach its limits, and what the options might be. If you appreciate these things, I think you might agree that the monetary system would not likely collapse in a random fashion but be triggered when a coalition of corporate and banking interests, both public and private, determine that they are ready to profit from that transformation. In this chapter I will argue that senior officials’ knowledge of the impending collapse of monetary systems can best explain why, a few years ago, they switched focus from managing inflation to, with the excuse of the pandemic, prioritising support for the largest corporations headquartered in their countries in their neo-colonial race to acquire assets around the world.

Listen to the full chapter here.

Donate to keep Jem writing / Read his book Breaking Together / Read Jem’s key ideas on collapse / Subscribe to this blog / Study with Jem / Browse his latest posts / Read the Scholars’ Warning / Visit the Deep Adaptation Forum / Receive Jem’s Biannual Bulletin / Receive the Deep Adaptation Review / Watch some of Jem’s talks / Find Emotional Support / Jem’s actual views on Covid

[i] Andrew Bailey’s (Governor of the Bank of England’s) letter to Rishi Sunak MP. https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/873217/5E70FECD.pdf

Discover more from Prof Jem Bendell

Subscribe to get the latest posts sent to your email.